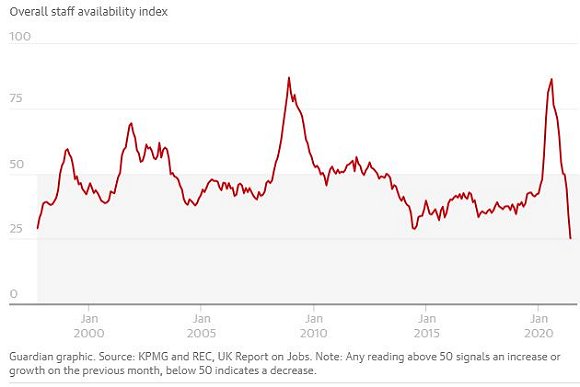

Britain’s employers are struggling with the worst staff shortages since the late 1990s, amid the rush to reopen from lockdown and a sharp drop in overseas workers due to Covid and Brexit.

Sounding the alarm over the risks to economic recovery from acute labour shortages, the Recruitment and Employment Confederation (REC) and the accountancy firm KPMG said the number of available workers plunged in June at the fastest rate since 1997.

Recruitment firms are reporting hiring challenges across several sectors of the economy, led by shortfalls in areas such as transport and logistics, hospitality, manufacturing and construction.

Staff availability has fallen at the quickest rate on record

As well as the trouble recruiting chefs, kitchen porters, cleaners and warehouse staff recorded in previous months, the snapshot indicated that issues for employers were spreading to typically higher-paying sectors such as finance, IT, accounting and engineering.

“We need action from businesses and government to reskill and upskill furloughed and prospective workers now more than ever, as the increasing skills gap in the workforce has the potential to slow the UK’s economic recovery,” said Claire Warnes, head of education, skills and productivity at KPMG UK.

The rush to reopen after pandemic restrictions is leading to bottlenecks. Employers are finding added complications as fewer EU workers travel to Britain because of Covid-19 border controls and the government’s post-Brexit immigration rules.

Online job adverts show demand for workers is soaring in some sector

According to the REC and KPMG survey of more than 400 recruitment firms, a sharp rise in hiring demand led to the unprecedented fall in the availability of candidates in June. Recruiters noted that increased hiring, Brexit, pandemic-related uncertainty and the furlough scheme all weighed on the number of jobseekers available.

Official figures show about 1.5 million workers are still furloughed with pandemic restrictions still limiting a full return to work, after the government pushed back the date for the end of most pandemic restrictions to 19 July and the Delta variant fuelled rising infections.

Rishi Sunak last week started to wind down the multibillion-pound jobs scheme, which is due to close at the end of September. At its peak almost 9 million jobs were furloughed during the first wave of the pandemic, with about 5 million in the wave in January this year.

UK unemployment has fallen since the easing of Covid-19 restrictions

Unemployment in the UK has fallen in recent months as firms scrambled to hire, dropping to 4.7%, or about 1.6 million people. The Bank of England forecasts that unemployment would rise to 5.5% after furlough ends. However, this is significantly below expectations last year that Covid-19 would drive up job losses at the fastest rate since the 1980s, leading to 12% unemployment.

In a sign of the growing pressure on companies, surveys from the British Chambers of Commerce published on Thursday showed 70% that had tried to hire staff in the three months to June had struggled to do so.

According to the poll of 5,700 companies, 52% said they tried to hire staff over the three months to June. The sectors with the biggest problems recruiting workers were construction, hotels and catering, and manufacturing.

Jane Gratton, head of people policy at the BCC, said part of the issue for employers was that skills shortages that had existed in Britain before the pandemic were becoming apparent once more as the economy reopened. “The encouraging increase in job creation across the manufacturing and services sectors is being held back by recruitment difficulties at all skill levels, jeopardising growth and productivity,” she said.

An estimated 1.3 million non-UK workers have left the country during the pandemic. Business leaders said easing post-Brexit immigration rules could help address shortages, but also called for further investment in skills and training from the government to increase the numbers of domestic candidates.

Employment experts believe people are being put off from work in certain sectors that have developed reputations for low pay and poor conditions in recent years, and that concerns over continuing high rates of Covid-19 are also having an impact.

Sustained labour shortages could lead employers to push up wages, which could in turn feed through to rising inflation if companies raise their prices to accommodate higher wage bills. However, there is debate about whether bottleneck pressures as the economy reopens from lockdown will translate into a permanently tighter jobs market.

Neil Carberry, the chief executive of the REC, said: “The jobs market is improving at the fastest pace we have ever seen, but it is still an unpredictable time. We can’t yet tell how much the ending of furlough and greater candidate confidence will help to meet this rising demand for staff.”

Read more here